Gold for the Long Term

Over the years we have seen instances where new investors enthusiastically acquire their metals, only to immediately cancel their order following a pullback of their metal’s spot price. As sure as the sun rises and sets, metals’ prices will fluctuate, and sometimes in dramatic fashion. It is important to consider that your precious metals investment(s) should be approached with a long-term strategy in mind.

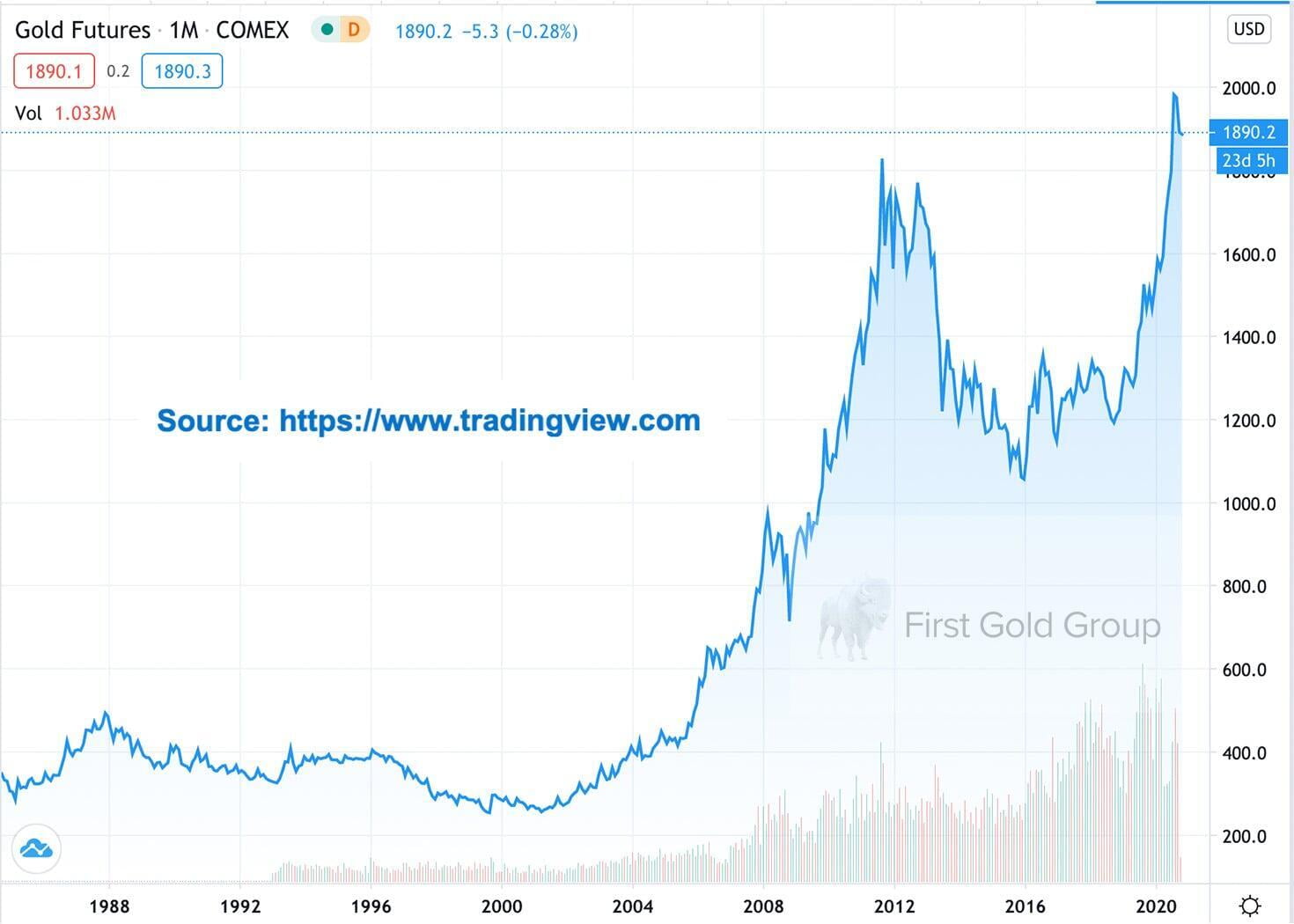

Some convincing data found on Investopedia supports the perspective that a long-term strategy should accompany your investment in metals. Between 1934 and 1971 the price of gold was effectively set at $35 per ounce. “Using the set gold price of $35 and the price of $1,650 per ounce as of April 2020, a price appreciation of approximately 4,500% can be deduced for gold. From February 1971 to 2020, the DJIA has appreciated in value by 3,221%.”

As you know, gold performed even better after April 2020, but this article’s data makes convincing case for a long-term strategy when investing in metals. If you are thinking 49 years is too long, fine, over 15 years the price of gold increased roughly 330% using the same April 2020 time frame.

I once heard a statement that may be worth some serious consideration: “Don’t wait to buy gold, buy gold and wait.”

Source: Lioudis, N. (2020 September 24) Has Gold Been a Good Investment Over the Long Term?. Retrieved from https://www.investopedia.com/ask/answers/020915/has-gold-been-good-investment-over-long-term.asp#citation-1